In the ever-evolving landscape of cryptocurrencies, Bitcoin stands as a beacon of innovation and opportunity. However, what often lies beneath the surface for aspiring miners is the intricate web of costs associated with acquiring mining equipment. In France, as elsewhere, the journey into Bitcoin mining is not merely about purchasing a mining rig; it requires a deeper understanding of the fundamental expenses, potential returns, and the current state of the cryptocurrency market.

At its core, a mining rig represents the heart of any mining operation. These machines are engineered to solve complex mathematical problems that validate transactions on the Bitcoin network. The higher the hash rate of your rig, the more potential you have to earn Bitcoin rewards. However, acquiring a powerful mining rig can incur significant costs, often leading miners to question the viability of their investments.

As the cryptocurrency market experiences fluctuations, the price of mining machines can vary dramatically. For example, a top-tier ASIC miner capable of delivering exceptional hash rates may set you back several thousand euros. Furthermore, the ongoing advancements in mining technology imply that today’s cutting-edge rig can become obsolete tomorrow. Therefore, miners must remain vigilant, ready to adapt to new innovations while managing their initial investments wisely.

Another formidable cost to consider is electricity. Mining operations require significant power, and in France, electricity prices can vary by region. Miners need to conduct a thorough analysis of their potential electricity costs—optimally identifying locations with competitive energy pricing. Beyond mere kilowatt-hour rates, the overall infrastructure to support a mining farm, including cooling systems and ventilation, adds layers of complexity and expense that should not be overlooked.

Beyond equipment and energy costs, one must consider network connectivity and hardware maintenance. A stable internet connection is crucial for miners, as the cryptocurrency network must be accessed continuously to maximize mining efficiency. Similarly, maintaining your hardware in peak condition is essential, with repairs or replacements potentially causing disruptions in mining operations. Such diligence may incur additional costs that can pile up over time.

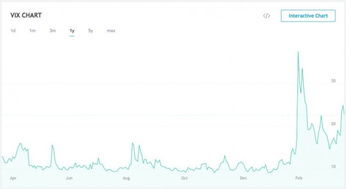

<pThe market dynamics are equally important. Bitcoin's price is heavily influenced by various external factors such as regulatory changes, market sentiment, and competitor currencies like Ethereum and Dogecoin. These fluctuations can directly impact the profitability of mining operations. Savvy miners must keep a pulse on market trends, as the price of Bitcoin can make or break the return on investment for mining equipment.

In the domain of cryptocurrency exchanges, a pivotal consideration is transaction fees. When miners successfully mine blocks and receive rewards, these cryptocurrencies often need to be exchanged for fiat currencies. The fees associated with these transactions can gradually accumulate, eroding potential profits from mining. Therefore, miners are urged to choose exchanges wisely, considering both the fee structures and their responsiveness to market changes.

For those who contemplate options beyond individual mining operations, hosted mining services offer an intriguing alternative. In essence, miners can rent space in a mining facility, effectively outsourcing their operations. While this comes with its own set of costs, it can alleviate the burdens of hardware maintenance, electricity management, and cooling solutions. For many, the convenience and lower barriers to entry into the mining ecosystem can be worth the investment, creating a more balanced and diversified portfolio ultimately targeted at capitalizing on crypto tides.

In summation, the quest for profitability in Bitcoin mining, particularly in France, requires a multifaceted approach to understanding the array of underlying costs associated with mining equipment and operations. While the allure of Bitcoin remains undeniable, aspiring miners must confront the realities of equipment, energy consumption, market volatility, and operational choices. Striking the right balance is crucial not only for survival in this competitive arena but also for seizing the burgeoning opportunities that await in the world of cryptocurrencies. Investing in knowledge is as crucial as investing in equipment; thus, continuous education and adaptation will ultimately determine success.

Leave a Reply